Our family is now embarking on the next phase of growth:

Over the upcoming 10 years, we will be applying our understanding of the sector and our knowledge of how to run successful businesses to buy 8-10 operating companies using a combination of sources of finance, including bank debt, Roadstead preference shares (see alongside) and DGR equity. We invite you to invest alongside DGR through Roadstead (The Roadstead Fund B.V.). The Roadsteadfund B.V. is registered at the Dutch AFM.

THE ROADSTEAD FUND

Introduction

The Investment Opportunity

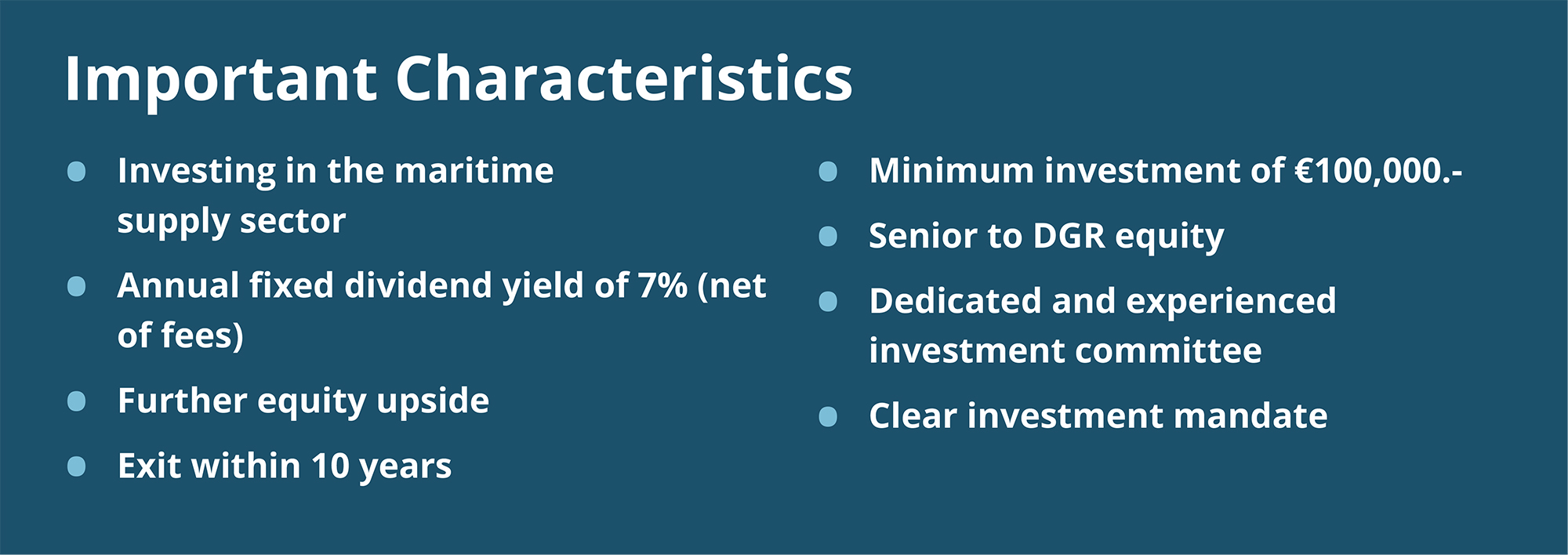

Invest in preference shares in The Roadstead Fund

DGR will be making 8-10 acquisitions and will use a combination of sources of finance to fund these acquisitions, including bank debt, Roadstead preference shares and DGR equity

Roadstead preference shares are lower risk, preferred shares, senior to DGR equity

• Benefit from preferred cash dividends

Preference share returns will be earned through

• Fixed annual dividend yield of 7% (net of 0.5% fees), compounding and

• Equity upside

The preference shares may be redeemed from the endof year 5, but no later than the end of year 10

Minimum initial investment of €100,000, with larger investments to be drawn down from investors as acquisition opportunities are finalised

Unique value add of DGR as the lead shareholder

Maritime expertise

We only invest in what we know, the maritime sector.

We are passionate and knowledgeable about maritime due to:

• Our hands-on, technical understanding of the needs of customers/end users

• Our ability to leverage our wide international network of contacts, with proven capability in building businesses with a global reach

A proven team

We benefit from the strength of a proven team, comprising deep experience across two generations, and a disciplined approach

• We combine fresh new thinking with established, tried and tested methodologies

• We value good governance and hold our management teams accountable

Long term, strategic outlook

As majority shareholder in all of our portfolio companies and being a family office, DGR is able to take a long-term view, driving growth in a responsible and sustainable manner